/cloudfront-us-east-1.images.arcpublishing.com/gray/LLBZH2UPP5GY3KRSCSQCYVIW6Q.jpg)

Once you make the payment, you’ll get a confirmation number. To qualify for a tax extension, you must file the appropriate form by the standard tax filing deadline of Ap(or Ap. Interestingly, according to the IRS taxpayers who make their 2019 tax payment by July 15 will automatically be given an extension without filing a request. The tax extension deadline is the regular tax deadline. 15 to file, but taxes owed are due by July 15.” What are the alternative ways to get an October 15 extension? “The extension gives taxpayers until Oct. “To get an extension, taxpayers must estimate their tax liability on the extension form and pay any amount due,” according to IRS.gov.

2016 tax extension online free software#

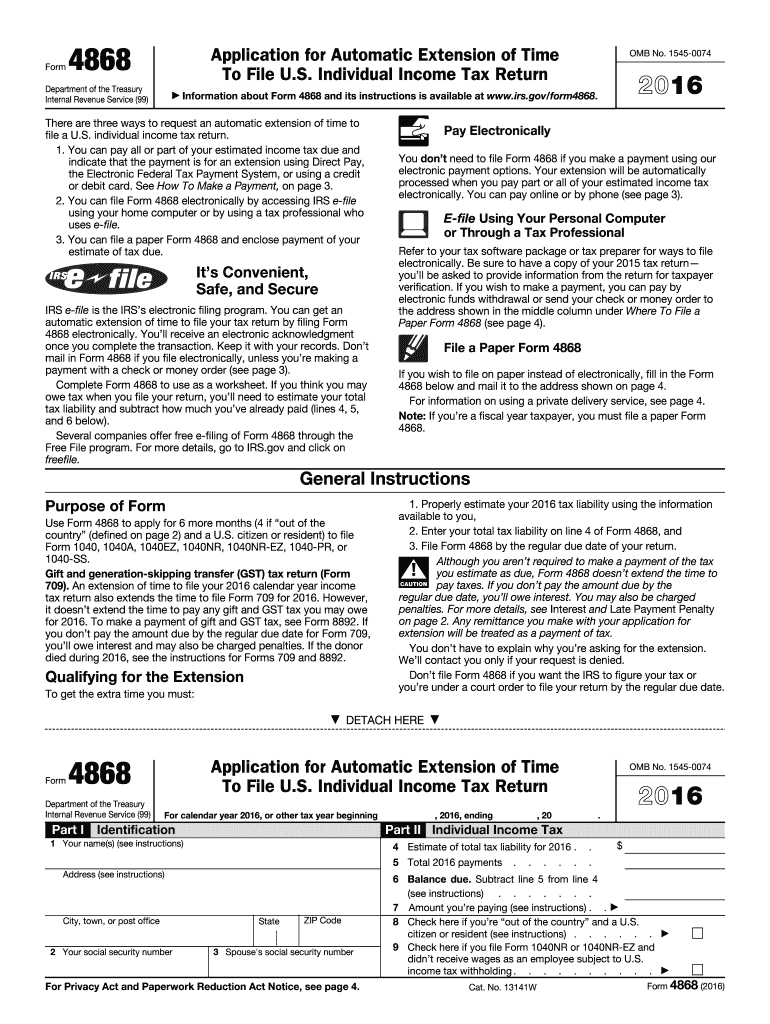

Individual Income Tax Return (Form 4858) by July 15.Īccording to the IRS, this form can be completed electronically through the IRS Free File or a tax software provider. Taxpayers who’d like an extension until October 15 must fill out an Automatic Extension of Time to File U.S. In 2022 all extensions purchased on include our 1040 tax return software, completely free of charge. How do I file an automatic extension until October 15? File Your Tax Extension Our website does offer the ability to e-file your tax extension electronically for a fee of 24.99.

But individual taxpayers who are unable to meet the July 15 deadline can request an automatic extension til October 15. To enjoy unlimited access to our journalism, subscribe today.Īs the pandemic swept across the nation in March, the Internal Revenue Service moved the original tax filing deadline and tax payment deadline from April 15 to July 15. Our mission to help you navigate the new normal is fueled by subscribers. Tax Extension Online Extend Tax Return & Maximize Deductions Rushing your Tax Return Increases Mistakes - Extend for FREE.

0 kommentar(er)

0 kommentar(er)